Are you considering upgrading to Revolut Premium? The Revolut Premium card offers a wide range of benefits that go beyond the free Standard plan. But is it worth it for everyone? In this article, we'll explore everything that the Premium plan has to offer, helping you make an informed decision.

What is Revolut Premium?

Revolut Premium is a paid plan that unlocks a multitude of extra benefits for Revolut users. It sits between the free Standard plan and the higher-tier Metal plan. With Revolut Premium, you'll gain access to exclusive features in categories such as travel benefits, security and protection, savings and investments, and customer support.

Image: Revolut Premium Card Review

Image: Revolut Premium Card Review

Revolut Premium Review Of Key Features

Revolut Premium comes with a host of impressive features. Let's take a closer look at some of the top ones to help you determine if upgrading your plan is worth it.

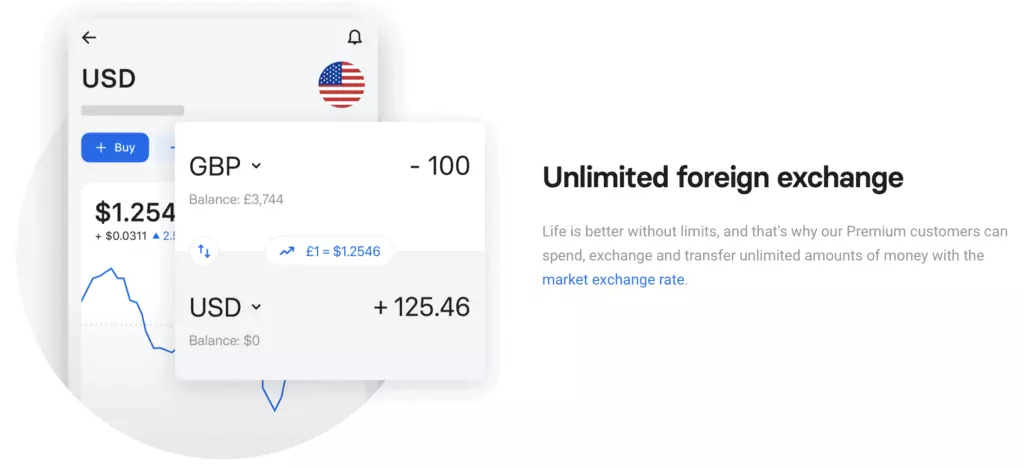

Unlimited Foreign Exchange And Transfers

Foreign exchange fees can quickly accumulate when you're overseas. With Revolut Premium, you can wave goodbye to that problem. You can send money overseas at the real international exchange rate, which is often better than what traditional banks offer. You can also perform direct bank transfers into over 140+ foreign currencies through the Revolut app at the interbank exchange rate. This feature can save you a significant amount of money, especially if you frequently deal with different currencies.

Image: Unlimited Foreign Exchange

Image: Unlimited Foreign Exchange

No Fees On ATM Cash Withdrawals

Say goodbye to annoying ATM withdrawal fees! Revolut Premium members enjoy free ATM withdrawals worldwide up to a certain amount. While you may still have to pay the fees charged by the ATM itself, the amount you can withdraw is significantly higher compared to the free Standard plan. This benefit is particularly useful when traveling to countries where card payments are not widely accepted.

One-Time Use Virtual Cards

Revolut Premium members have access to one-time use disposable virtual cards. These cards provide an extra layer of protection for online transactions. Once you use the card, it is automatically deleted, making it useless for potential thieves. This feature is especially helpful for online payment subscriptions that you're unsure about or when you want to avoid automatic renewals.

Image: Revolut Virtual Disposable Cards

Image: Revolut Virtual Disposable Cards

Free Global Express Delivery

Revolut Premium offers free express delivery of your new card. Whether you're at home or traveling abroad, Revolut will send the card directly to your location. Express delivery ensures that you'll receive the card within 1-3 business days, and you'll have access to free tracking to keep an eye on its progress. This feature is a significant improvement over the standard delivery times of the free Standard plan.

Image: Global Express Delivery

Image: Global Express Delivery

LoungeKey Pass Access

Revolut Premium offers access to the LoungeKey Pass, granting you entry to over 1,000+ airport lounges worldwide. This is an excellent perk for travelers, remote workers, and digital nomads who appreciate a comfortable and productive environment while waiting for their flights. LoungeKey Passes can be purchased at a discounted rate, making it a more affordable option compared to paying directly at the lounge.

Image: Revolut Lounge Access

Image: Revolut Lounge Access

Smart Delay Free Lounge Passes

For those moments when your flight is delayed by one hour or more, Revolut Premium has you covered. Through the Smart Delay feature, Revolut will issue you with two free lounge pass QR codes, allowing you and a companion to enjoy a comfortable lounge while you wait. This feature is automatic and doesn't require you to notify Revolut about the delay. It's a convenient perk that can make unexpected flight delays more tolerable.

Image: Smart Delay Free Lounge Pass

Image: Smart Delay Free Lounge Pass

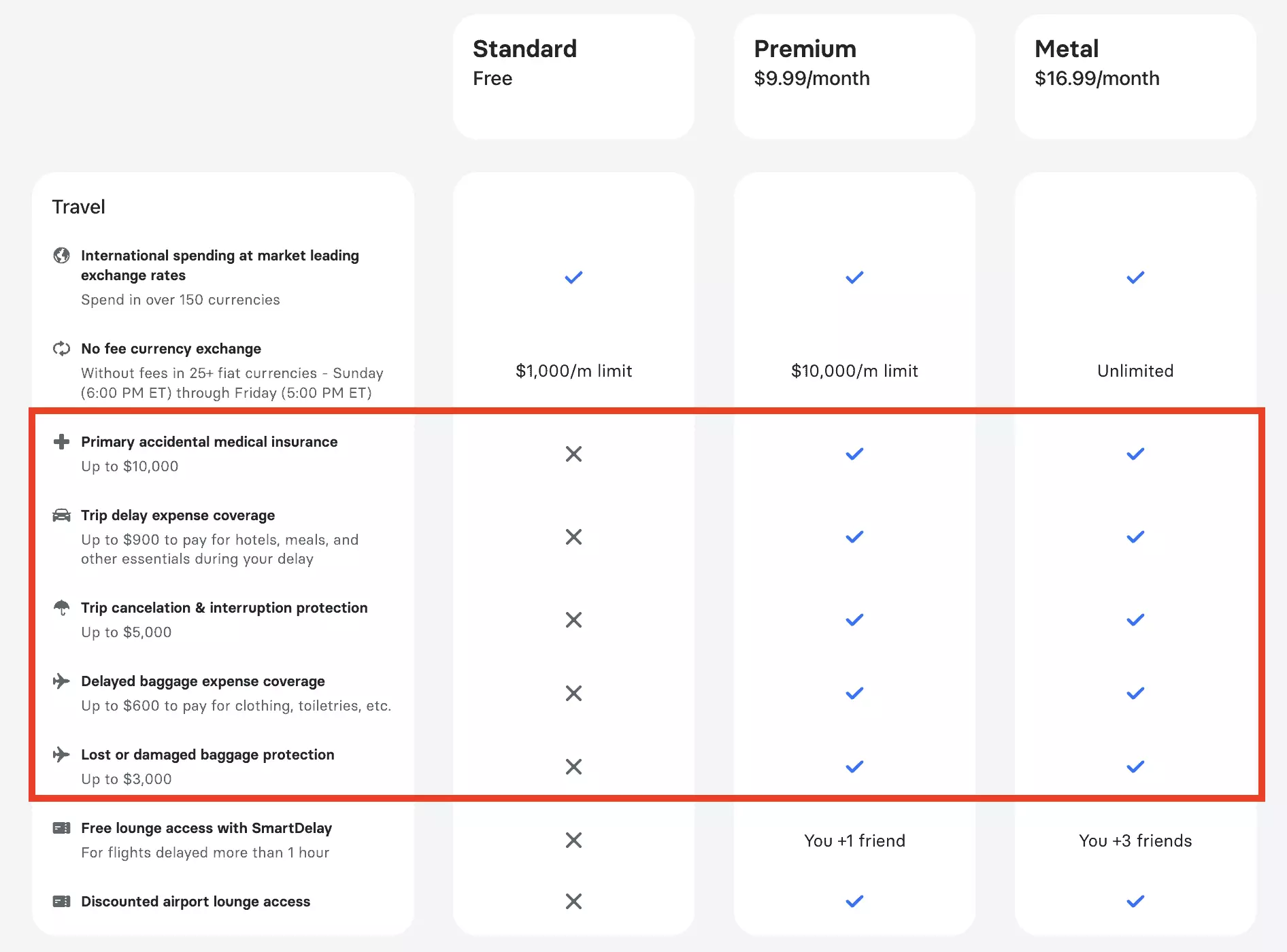

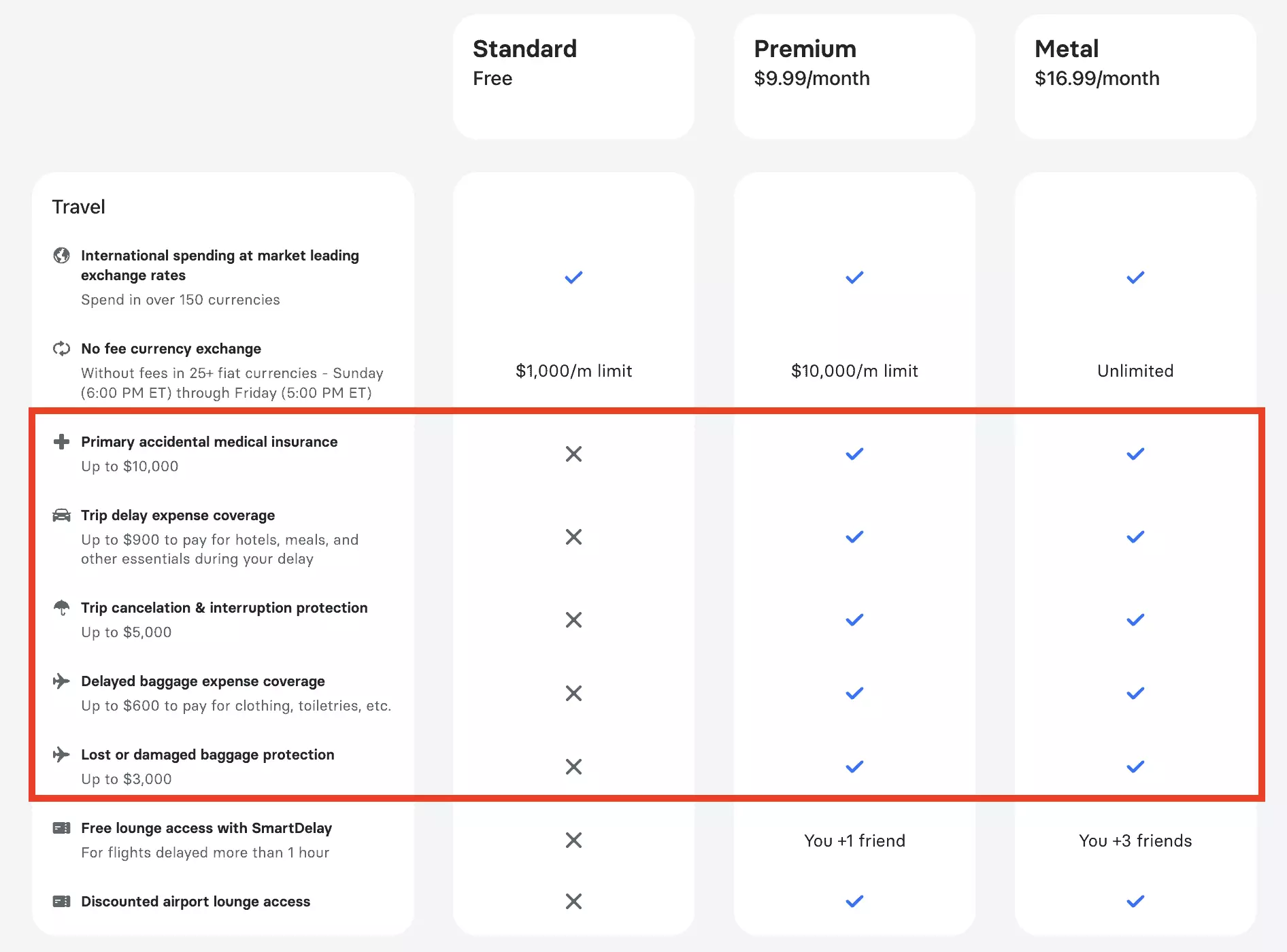

Travel Insurance & Medical Insurance

Revolut Premium offers travel and medical insurance for members in the European Economic Area, the United Kingdom, and the United States. The coverage includes various benefits such as foreign accidental emergency medical expenses, emergency dental treatment, trip interruption and cancellation protection, delayed flights and luggage protection, and lost or damaged baggage protection. It's essential to review the specific policy details for your country of residence to ensure it meets your needs.

Image: Revolut Travel Insurance Overview

Image: Revolut Travel Insurance Overview

And Many More...

Revolut Premium also offers priority customer support, an exclusive premium design card, premium security and travel protection, savings and investments options, and additional perks depending on your country of residence.

Revolut Premium Pricing

Revolut Premium offers excellent value for its pricing. The current monthly payment varies by country:

- United States: $9.99 USD per month

- United Kingdom: £7.99 per month

- Europe: €8.99 per month

- Australia: $9.99 AUD per month

While the Premium plan requires a 12-month commitment, the benefits you receive often surpass the cost. The money you save on foreign transactions alone can easily cover the monthly fee. However, it's important to note that canceling early may incur a dishonor fee equivalent to two months' payment. Upgrading to Revolut Metal is possible without additional fees, except for the Metal plan's cost itself.

Pros And Cons of Revolut Premium

Let's take a quick look at the pros and cons of Revolut Premium:

Revolut Premium Pros

- Abundance of great features for digital nomads, travelers, and remote workers

- Affordable pricing compared to similar travel cards and digital banks

- Exclusive card design and color options

- Increased free ATM withdrawal limits in most countries

- Lower cryptocurrency and stock trading service fees

- Simple and fast plan upgrade process

- Express delivery of Premium card

Revolut Premium Cons

- Commitment to a 12-month plan

- Limited travel insurance coverage for trips exceeding 40 days

- Varying plan benefits based on country of residence

Revolut Premium vs Revolut Standard vs Revolut Metal

It's worth comparing Revolut Premium with the other plans offered by Revolut. Here's a breakdown of the features and benefits of Revolut Standard, Premium, and Metal:

| Plan | Price | Spend in currencies | Hold in currencies | Out-of-network ATM withdrawals | Crypto, Commodity & Stock Trading | Saving Account APY Earnings | Free Card Delivery | Travel Insurance | LoungeKey Pass Access | Priority customer support |

|---|---|---|---|---|---|---|---|---|---|---|

| Standard | Free | 150+ | 30+ | Up to $1,200/month | Yes | 0.05% APY (depends on country) | Standard (5-10 business days) | No | No | Standard |

| Premium | $9.99/month | 150+ | 30+ | Up to $1,200/month | Yes | 0.07% APY (depends on country) | Express (1-3 business days) | Yes (depends on country) | Discounted | Priority |

| Metal | $16.99/month | 150+ | 30+ | Up to $1,200/month | Yes | 0.07% APY (depends on country) | Express (1-3 business days) | Yes (depends on country) | Discounted | Priority |

New Revolut Plus Card

Revolut recently introduced the Plus plan, currently available to UK and European citizens and residents. Priced at £3.99 per month, the Plus plan offers additional benefits such as 24/7 priority customer support, better international ATM cash withdrawals, purchase protection, and higher interest rates on savings. While it's a more affordable option, consider whether upgrading to Premium might be more worthwhile in the long run.

Final Thoughts

Revolut is an excellent digital banking solution, and the Premium plan further enhances its offerings. Whether upgrading to Revolut Premium is worth it depends on your usage and travel habits. If you frequently travel and use Revolut as your primary card payment method, the unlimited foreign exchange, increased ATM withdrawal limits, and added perks make it a compelling choice. However, if you primarily use Revolut within your home country or don't meet the criteria for the included travel insurance, the benefits of Revolut Premium may be less significant. Evaluate your own needs and consider whether the features and advantages align with your financial lifestyle.