Virgin Voyages is known for offering adults-only cruises with high tech amenities, low environmental impact, and complimentary drinks and dining. While they provide a variety of cruise options and cabin types, their travel insurance options are limited. Let's take a closer look at their Voyage Protection plan and see if it's worth considering.

Background

Virgin Voyages' Voyage Protection plan is underwritten by Arch Insurance Company, a strong insurance partner, and administered by Aon Affinity. It can be easily purchased at checkout when booking your cruise online, which is a convenient feature. However, it's important to understand what exactly you're getting for the $192 cost.

Our Cruise: French Daze & Ibiza Nights

For our review, we chose the French Daze & Ibiza Nights cruise. Our sample couple, aged 55 and 60, will be staying in The Insider suite, sailing from 5/22/22-5/29/22. The cruise starts and ends in Barcelona, with stops in Marseille, Cannes, Olbia, and Ibiza. The total cost of the cruise is $2,600 after taxes and fees.

Comparison Quotes

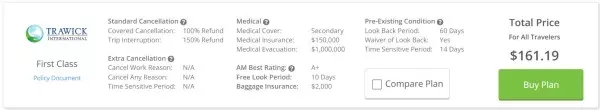

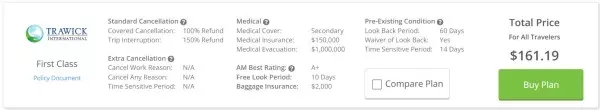

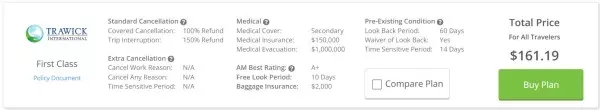

To evaluate the value of Virgin Voyages' travel insurance, we compared it with two policies available at Cruise Insurance 101. The Trawick First Class plan, priced at $161.19, offers comprehensive coverage with $150,000 in Medical Insurance and $1 million in Medical Evacuation coverage. The John Hancock Silver (CFAR 75%) plan, costing $262.50, provides a Pre-Existing Condition Waiver and cancellation benefits, along with $100,000 in Medical Insurance and $500,000 in Medical Evacuation coverage.

How Does Virgin Voyages Compare to the Competition?

When we compare the benefits of the Voyage Protection plan with other options, it becomes evident that it falls short in several areas. The Medical Insurance and Medical Evacuation coverage have low limits of $10,000 and $25,000, respectively. Moreover, the policy does not cover Pre-Existing Conditions and lacks a Cancel For Any Reason option.

In contrast, both Trawick First Class and John Hancock Silver (CFAR 75%) offer better coverage at similar or slightly higher costs. Trawick First Class provides $150,000 in Medical Insurance and $1 million in Medical Evacuation coverage, while John Hancock Silver (CFAR 75%) offers $100,000 in Medical Insurance and $500,000 in Medical Evacuation coverage, along with a Pre-Existing Condition Waiver.

Trip Cancellation Reimburses You If You Can't Travel

Trip Cancellation is an essential benefit that allows you to get a full reimbursement of your pre-paid, non-refundable trip costs if you must cancel for a covered reason. Unfortunately, Virgin's cruise insurance covers only six cancellation reasons, whereas other policies typically include a more comprehensive list. For instance, Trawick First Class and John Hancock Silver (CFAR 75%) offer 14 covered cancellation scenarios, including theft of passports or visas, permanent transfer of employment, and inclement weather causing a complete cessation of services.

Cancel For Any Reason

Virgin Voyages does not offer a Cancel For Any Reason option, which allows you to cancel for any reason not covered by the policy and still receive a reimbursement of your trip cost. However, policies like John Hancock Silver (CFAR 75%) provide this benefit, allowing you to cancel for any reason and receive a cash reimbursement for a portion of the trip cost.

Trip Interruption Refunds the Unused Portion of Trip

Trip Interruption coverage reimburses you for the missed portion of your trip if you experience a covered disruption. While Virgin's policy offers 100% trip cost refund for a covered interruption, both Trawick First Class and John Hancock Silver (CFAR 75%) cover up to a 150% refund, which helps cover the added cost of transportation.

Medical Insurance When Traveling Overseas

When traveling overseas, having proper Medical Insurance is crucial, as many countries with universal healthcare programs don't provide free treatment for travelers. Virgin's Voyage Protection plan includes only $10,000 of Medical Insurance, which is insufficient in case of emergencies. On the other hand, Trawick First Class provides $150,000 in coverage, and John Hancock Silver (CFAR 75%) offers $100,000 in coverage, which is more suitable for seniors cruising outside of the US.

Emergency Medical Evacuation Brings You Home

Medical Evacuation coverage is essential for unexpected emergencies that require transportation from the place of injury or illness to a local hospital and, if necessary, back home. Virgin's policy offers a minimal $25,000 Medical Evacuation benefit, while Trawick First Class provides $1 million in coverage, and John Hancock Silver (CFAR 75%) offers $500,000 in coverage. Having adequate coverage is crucial, especially when traveling outside the US.

Pre-Existing Medical Conditions

Pre-Existing Conditions can be a concern for many senior travelers. While Virgin Voyages' policy looks back only 60 days into your medical history (compared to 90 or 180 days with other policies), it does not cover Pre-Existing Conditions at all. In contrast, both policies from Cruise Insurance 101 offer a Waiver of Pre-Existing Conditions if purchased within 14 days of the initial payment or deposit.

Conclusion

In conclusion, while Virgin Voyages offers contemporary cruising experiences, their travel insurance falls short in critical areas such as Trip Cancellation, Medical Insurance, Medical Evacuation, and covering Pre-Existing Conditions. Considering the limited coverage provided by the Voyage Protection plan and its cost of $192, it isn't the most comprehensive or cost-effective option available.

We recommend exploring other travel insurance options, such as Trawick First Class or John Hancock Silver (CFAR 75%), which offer better coverage for a similar or slightly higher cost. These policies provide adequate protection for your trip and additional benefits like Cancel For Any Reason and a Pre-Existing Condition Waiver. Keep in mind that you can insure all your travel arrangements, regardless of who you booked with, under a policy purchased in the wider travel insurance marketplace.

At Cruise Insurance 101, we offer a marketplace where you can compare different plans from top travel insurance carriers. Visit us first to explore your options and ensure you're selecting the right coverage for your needs. Safe travels!

Virgin Voyages Travel Insurance - 2024 Review

Virgin Voyages Travel Insurance - 2024 Review

Our Cruise: French Daze & Ibiza Nights

Our Cruise: French Daze & Ibiza Nights

Cruise Cabin

Cruise Cabin

Trawick First Class Quote

Trawick First Class Quote

John Hancock Silver (CFAR 75%) Quote

John Hancock Silver (CFAR 75%) Quote

Barcelona - A Destination to Visit

Barcelona - A Destination to Visit

Exploring Spain - A Beautiful Country

Exploring Spain - A Beautiful Country